Rocky Road in a nutshell

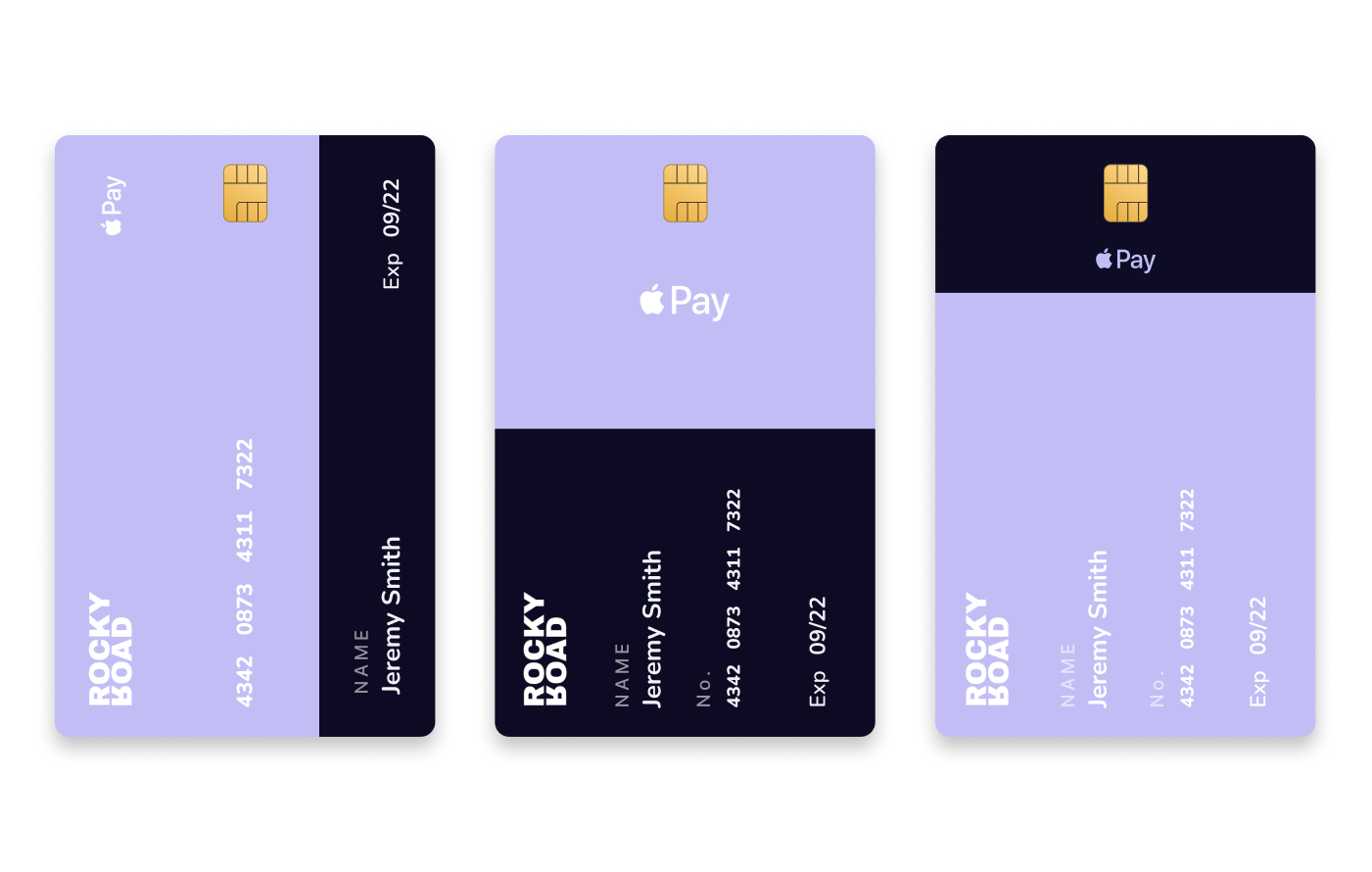

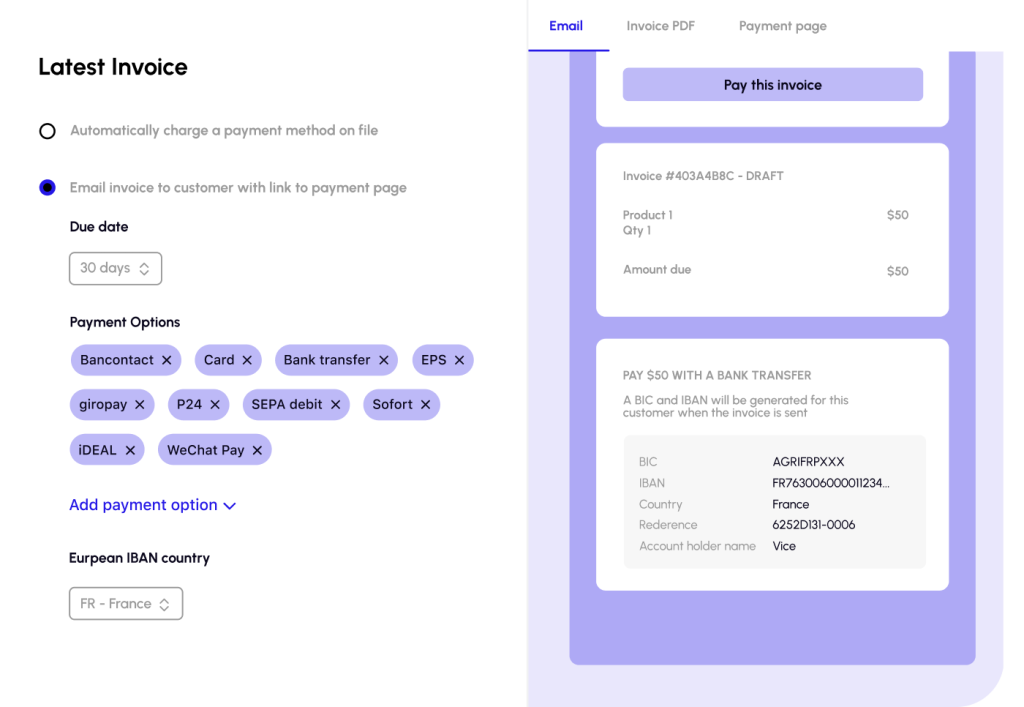

Credit or debit cards, virtual wallets or Apple pay, more than 30 payment methods supported. Integrate these payment methods into your platform with our simple, secure, and fast processing solutions, designed to fit the unique needs of businesses of all sizes.

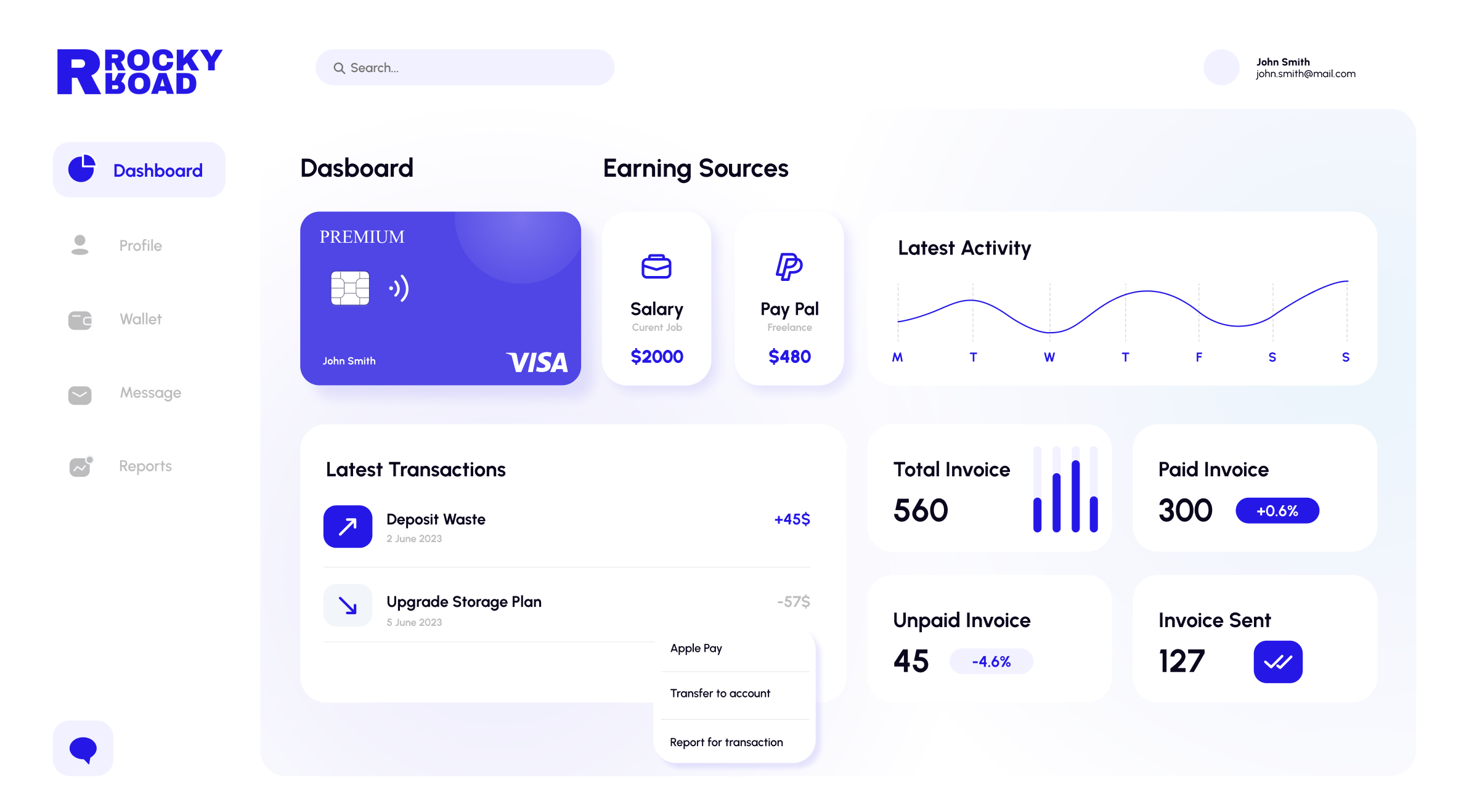

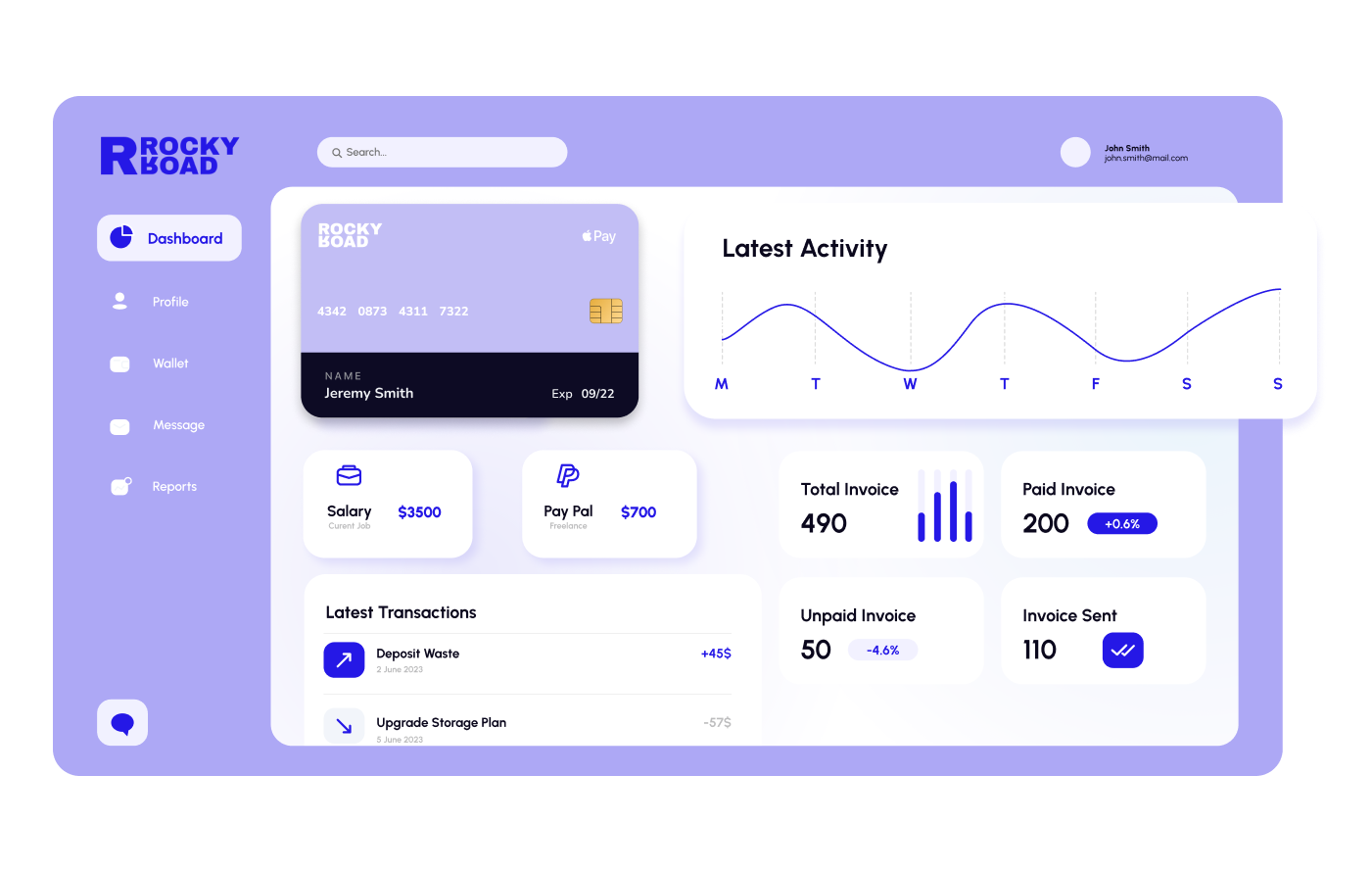

Manage subscriptions and recurring billings – monthly, annual or custom, 56 options are available. Easily track and analyze subscriber behavior with intuitive, data-rich dashboard that brings simplicity and efficiency to managing your recurring revenue streams.

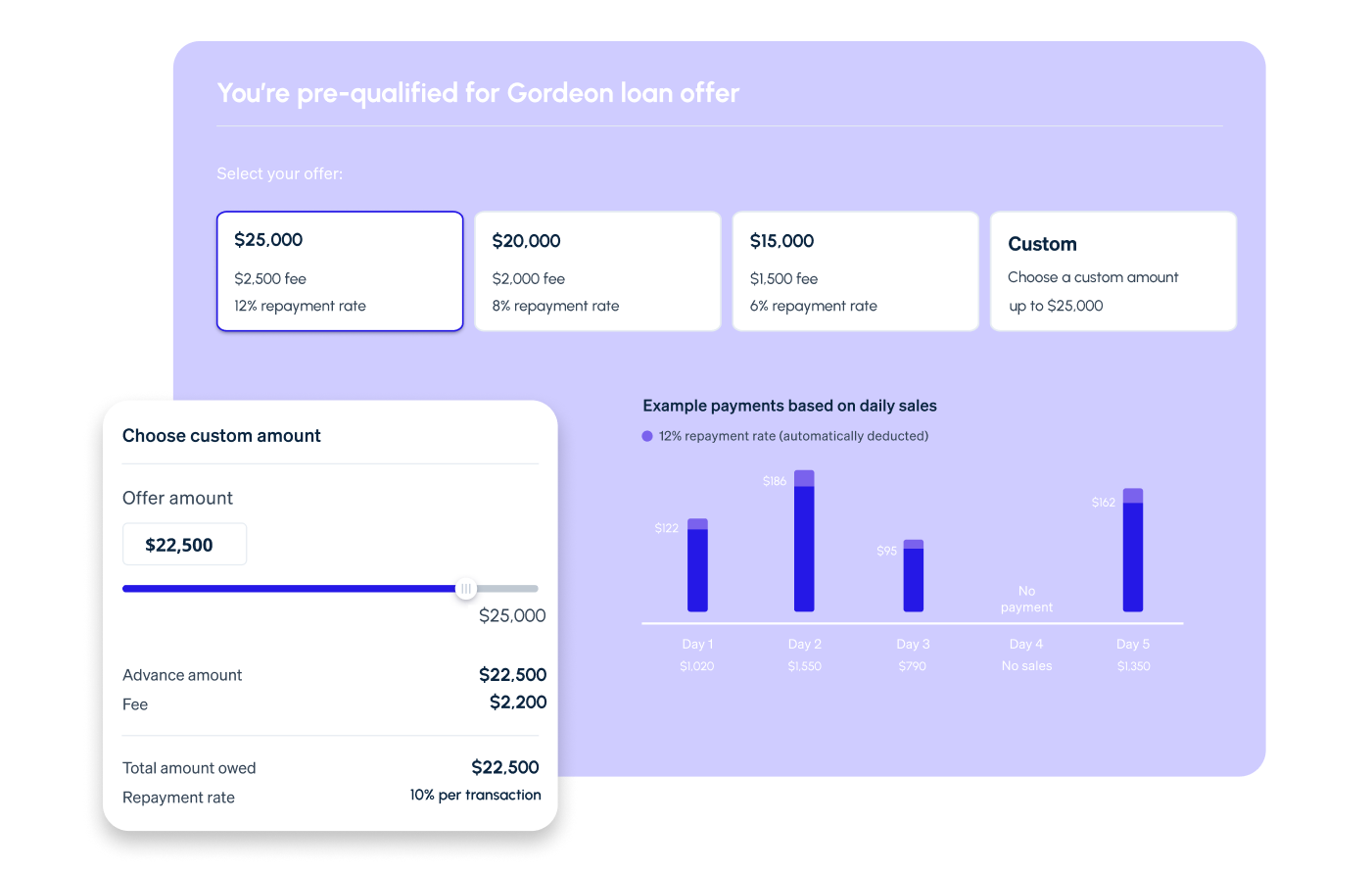

Request financing directly from Rocky – settle directly through your eCommerce sales. Our integrated financing solution offers quick, reliable, and transparent funding options to support your business growth, powered by your eCommerce performance.

With plugins for all major platforms and languages, integrate and go live with RockyRoad in less than an hour.

Design your own checkout 100 % as you want with our easy-to-use custom payment form builder

We offer 3-D Secure out of the box with our payment pop-up. 3-D Secure works both with Mastercard and Visa.

Real-time data and insights on your Dashboard to make informed business decisions.

Take the first step towards revolutionizing your business’s financial management today

Rocky Road Inc.

41 Madison Avenue, 25th and 31st Floors,

New York, 10010

2024 All Rights Reserved.